Unit Trust FAQ's

- Unit trusts offer you the flexibility to tailor a portfolio to suit your specific investment needs and time horizon.

- You can buy them directly or through a financial adviser.

- You can access the stock exchange without needing knowledge or experience of investing in equities.

- The ability to diversify (spread) your investment across markets, sectors and economies greatly reduces your investment risk.

- Money invested in unit trusts is easily accessible, especially in times of emergency.

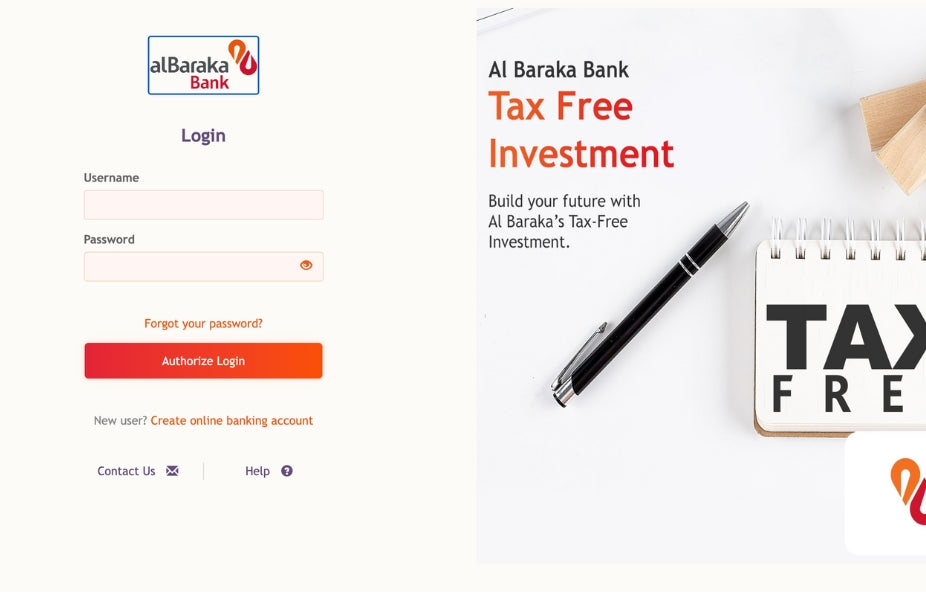

- Unit trusts are tax-efficient, providing tax exemptions on income and capital gains tax.

- Unit trusts offer exciting capital growth opportunities over the medium to long term.

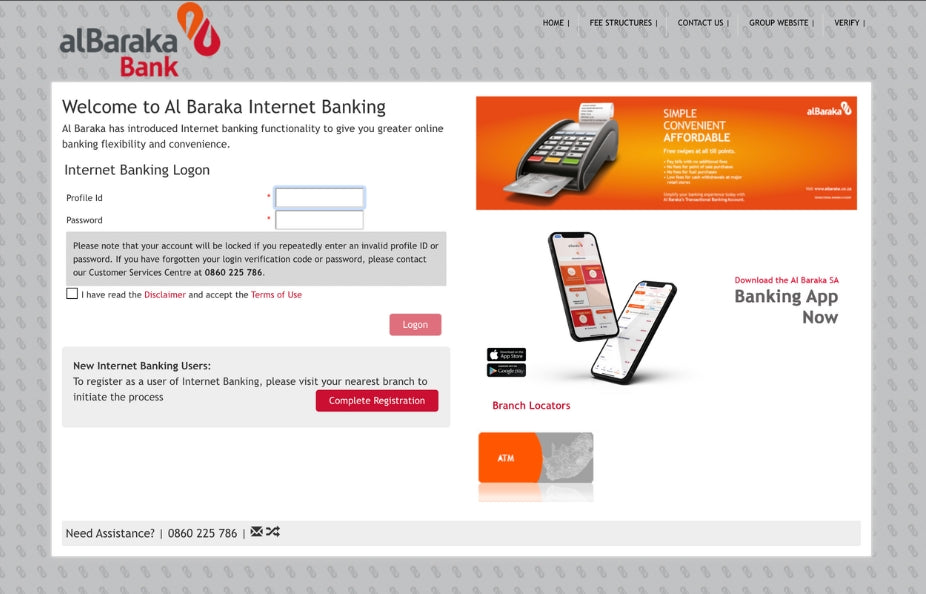

- Online transactional capability: you can buy, sell and switch units in your portfolio online

The Shari’ah Supervisory Board ensures that the investable universe is compliant with Shari’ah. The Board comprises internationally recognised scholars in line with the standards of the Accounting and Auditing Organisation for Islamic Financial Institutions (AAOIFI), which reflects global best practice.

The Board is independent of the fund manager. This ensures that the selection of the investment universe cannot be manipulated for the benefit of performance, at the expense of Shari’ah compliance.

Al Baraka Bank’s Internal Audit department is also responsible for monitoring the funds during the year, to ensure that at all times they comply with the fatwas and other directives issued by the Board. The depth of knowledge and expertise of the Board members ensure peace of mind for investors

MAAHIR JAKOET

• BCom (Hons) UCT, MBA

• 13 years of investment experience

FAWAZ FAKIER

• CFA, FRM, BCom honours (Finance)

• 18 years of investment experience

Get in touch

Please complete the form below and a member of our team will contact you as soon as possible: